Calculating the Net Worth of Your Small Business

The net worth of your small business is an excellent indicator for yourself, investors, and lenders of your company's value and performance after you pay all liabilities. You can use your net worth to secure funding, sell your business, or gain a clear picture of your company's financial health. Read on for guidance when you calculate your business's net worth.

The net worth of your small business is an excellent indicator for yourself, investors, and lenders of your company's value and performance after you pay all liabilities. You can use your net worth to secure funding, sell your business, or gain a clear picture of your company's financial health. Read on for guidance when you calculate your business's net worth.

Create a Balance Sheet

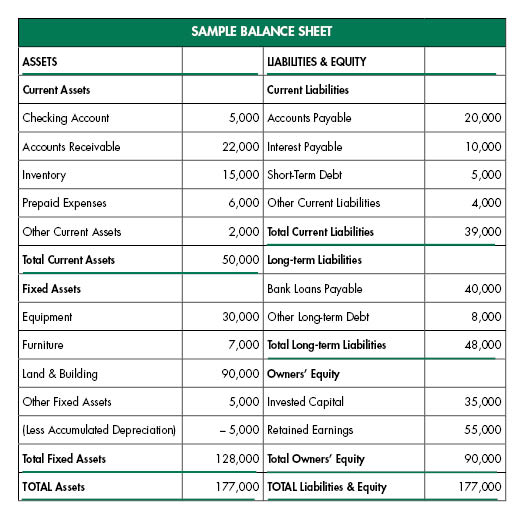

To grow your business or secure investors, you'll need an up-to-date balance sheet listing total assets to liabilities. A balance sheet provides a snapshot of your finances and is fundamental for any business. Download a balance sheet template from Score.org or use the sample balance sheet in this article. Assets, or resources that have economic value, are listed on the left side of the balance sheet. Liabilities are listed on the right side and include any debts or obligations you owe. Subtract the liabilities from the assets to determine the net worth. A business with a negative net worth will have difficulty getting approved for loans and other funding.

Types of Assets

Net worth only measures the accounting value of tangible items with a dollar amount. The market value includes intangible assets and increases the amount a buyer would pay to acquire the business. Intangible assets may be intellectual property such as copyrights, trademarks, and other non-physical resources that provide value to the company. You can break tangible assets into current and long-term assets. Current tangible assets, like invoices or inventory, can be converted into cash. Fixed tangible assets, like real estate and equipment, are long-term and used to run the business.

You can also divide assets into operating and non-operating. Operating assets are required for the business to function each day. These can include the company's bank accounts, inventory, and equipment. Non-operating assets are not as critical but are still needed to establish the business. These can consist of branding, patents, or trademarks.

Types of Liabilities

You can separate liabilities into current and long-term. Current, or short-term liabilities, are debts due within a year and can include salaries, mortgage payments, lines of credit, and short-term loans. Long-term liabilities extend past the current year and can consist of deferred taxes, interest payments, loans, etc.

You should include contingent liabilities if the liability is likely to occur and you can estimate the value for accounting records. Some businesses may also have contingent liabilities determined by the outcome of a future event. Examples of these are pending lawsuits or warranties that must be honored.

Find Help For Your Small Business

Maintaining a healthy net worth is the foundation of any successful business. A positive net worth helps you secure funding to grow your business. If you need help obtaining funds for your business, the Small Business Administration (SBA) has many tools available. Texell's Commercial Loan Officers are SBA experts and are ready to help with SBA 7(a) or 504 loans and more. Call or text 254.774.5161 or email BusinessLoans@Texell.org to get started.

If you wish to comment on this article or have an idea for a topic we should cover, we want to hear from you! Email us at editor@texell.org.