5 Credit Score Myths

A credit score provides a snapshot of an individual’s creditworthiness based on information in their credit report. Using a combination of your past credit and payment history, credit bureaus, and lenders, calculate your three-digit credit score. To build or improve your credit score, learn more about these common myths.

1. You Have to Pay to Request Your Score or Report

False. Your credit score is based on your credit report, and you can request your report from the three reporting bureaus—Equifax, Experian, and TransUnion—once a year at no cost.¹ Be cautious of websites posing as these credit bureaus offering a free report or a fee to share your credit score. Scammers use these opportunities for phishing websites to steal your personal information. Visit AnnualCreditReport.com to request your free report and check your credit history. Texell members can opt in to view their credit score at no cost in Digital Banking.

2. Checking Your Score or Report Hurts Your Score

False. Your score isn’t affected when you check it, and it’s recommended to check it regularly to be aware of potential fraud or identity theft. If you’ve maintained healthy credit use and notice a sudden dip in your score, you may be a victim of someone using your identity to open a line of credit without your knowledge.

3. You Only Have One Credit Score

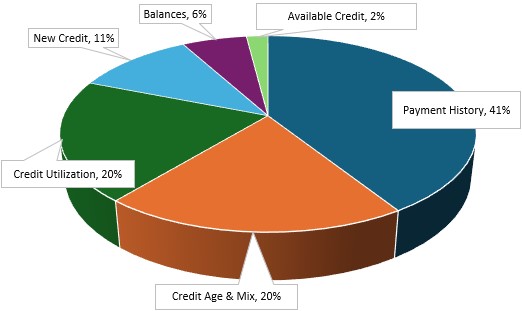

False. Several credit score models calculate your score based on many factors. The FICO Score and VantageScore are the most common models, and although they use many of the same factors, they assign different weights to those factors. Texell members have access to their credit score and report in Digital Banking, which uses VantageScore,² from TransUnion. VantageScore is a comprehensive scoring model that provides a better picture of overall credit health. The six major factors in order of how much weight, or influence, they have on your score include payment history, depth, utilization, balances, behavior, and credit. Let’s take a closer look at each factor and how it’s calculated:

- Payment History (41%) – Late payments significantly impact your score, and any account with a late payment can stay on your credit report for seven years. If you have an increased number of late payments, the more it affects your score.

- Credit Age/Mix (20%) – How long you’ve had credit accounts and maintained different types affect your score since it gives lenders a long-term view of how you manage your money. There are two main types of credit: revolving and installment debt. Revolving debts, like credit cards, have a monthly spending limit, but the bill could vary. Installment debt, like a loan or mortgage, has the same monthly payment.

- Credit Utilization (20%) – How much credit you use and have available to use impacts your score. This ratio between the amount you charge monthly and your total limit is called your credit utilization ratio. It’s recommended to keep this ratio below 30% to show you’re not relying too heavily on credit and spending beyond your budget.

- New Credit (11%) – Every time you apply for a new line of credit or loan, the lender makes a hard inquiry which drops your score a few points. Since you’re likely shopping around when applying for a loan, most scoring models consider all hard inquiries made within a 14-day period as a single inquiry.

- Balances or Amount Owed (6%) – Having a high balance on any credit account can hurt your score, even if you’re making payments on time.

- Available Credit (2%) – Although it doesn’t have a significant impact on your score, it’s always recommended to pay off your credit cards to increase your available credit and raise your score.

4. Carrying a Balance Improves Your Score

False. Carrying a balance on a revolving line of credit, like a credit card, is costly as you’ll pay more in interest and may fail to make payments as the balance rises. As mentioned in credit utilization, lenders prefer a lower ratio that’s below 30%, which shows you carry less risk of failing to repay the loan. If you pay off a credit card, think twice before closing the account as it reduces your available credit and could shorten your credit history.

5. You Can’t Change a Bad Score

False. If you’re made some mistakes, it’s not too late to improve your money management skills. Start by creating a budget and plan for paying down debt. Then look for options to build your credit back, like secured loans or credit cards. The lower your score is, the higher your interest rate will be and the more you’ll spend over the life of the loan. Learn more about improving your score in our article 4 Ways to Start Building Credit.

If you find information in your credit report that looks inaccurate, you can request the lender to update it or file a dispute with the credit bureaus. By law, the credit bureaus must investigate your dispute within 30 days and respond. Read about how to correct errors and start a dispute in Digital Banking in How to Correct Credit Report Errors.

Texell members can access credit scores, full credit report, credit monitoring and more for free in Digital Banking. SavvyMoney updates credit scores every seven days, and you can refresh full reports every 24 hours. The Score Simulator tool also makes recommendations for improving your score. Enrolling in SavvyMoney Credit Score is a soft inquiry and does not affect your score. For questions or help to enroll, send a secure message in Digital Banking or call or text 254.773.1604.

¹ Federal Trade Commission Consumer Advice from consumer.ftc.gov.

² The Complete Guide to Your VantageScore from vantagescore.com.

If you wish to comment on this article or have an idea for a topic we should cover, we want to hear from you! Email us at editor@texell.org.