What Is a CD Ladder?

A Certificate of Deposit (CD or certificate) ladder is a savings strategy where you stagger your certificate terms to reinvest in long-term certificates. This staggering allows you to spread your cash out over several certificates to maximize your interest rates. At the same time, the staggered maturity dates give you access to your money at regular windows.

A Certificate of Deposit (CD or certificate) ladder is a savings strategy where you stagger your certificate terms to reinvest in long-term certificates. This staggering allows you to spread your cash out over several certificates to maximize your interest rates. At the same time, the staggered maturity dates give you access to your money at regular windows.

Sound complicated? Follow this step-by-step process to build your ladder.

1. Open your CDs

Determine the total amount you will invest in your certificate ladder and divide that number by five. This number is the amount you will place in each of your certificates, as outlined below.

CD ladder example:

Say you use $50,000 to build a CD ladder that matures in one-year increments, you would open the following certificates:

-

-

- $10,000 in a 12-month certificate

- $10,000 in a 24-month certificate

- $10,000 in a 36-month certificate

- $10,000 in a 48-month certificate

- $10,000 in a 60-month certificate

-

2. Reinvest each CD as it matures

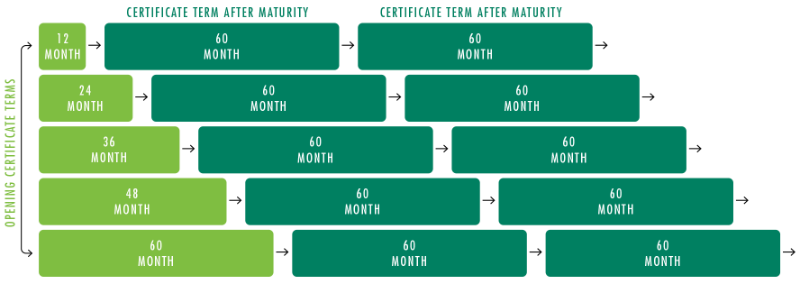

When your 12-month certificate matures, open a new 60-month certificate. When your 24-month certificate matures, open another 60-month certificate and repeat this process every time one of your certificates matures. You’ll have all five-year certificates in five years, allowing you to earn the highest yield, and every year you will have one certificate mature.

Your certificate ladder provides two key benefits:

1. Higher yields

As you cycle through your ladder, your funds will all be invested in 60-month certificates. You will be earning one of the highest rates available at the time of your certificate renewal. This allows you to earn higher yields without locking all of your funds in one 60-month CD.

2. Access to your money

If you lock all your money into a single certificate, you won’t be able to withdraw funds during the term of your certificate without a penalty. With a CD ladder, your maturity dates are staggered, and your next maturity date could be quite soon if you need access to some of your cash.

If a certificate ladder is right for you, Texell’s Account Heroes are here to help. You can get more information and check rates on Texell.org, and when it’s time to start your ladder, our online process is quick and simple, or you can visit any branch. If you have questions, we are happy to help at Services@Texell.org, or 855.773.1604.

If you wish to comment on this article or have an idea for a topic we should cover, we want to hear from you! Email us at editor@texell.org(opens in a new window)(opens in a new window)(opens in a new window).