What is Compound Interest?

Albert Einstein has been quoted as saying, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t pays it.” But what is compound interest, and why is it so important?

Albert Einstein has been quoted as saying, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t pays it.” But what is compound interest, and why is it so important?

Interest helps grow your savings. And the more often interest is added, or compounded, the more your savings grow as previously earned interest also earns interest itself when it’s compounded. Read more about the difference between simple and compound interest and the types of accounts that build wealth.

Simple vs. Compound Interest

Simple interest is earned only on the principal amount of the account. For example, if you invest $10,000 at a 5% interest rate, you collect $500 in interest each year, raising your savings by that amount. Compound interest is when your interest is reinvested, so you earn interest on both the principal amount and the interest itself. In these types of accounts, interest grows exponentially over time.

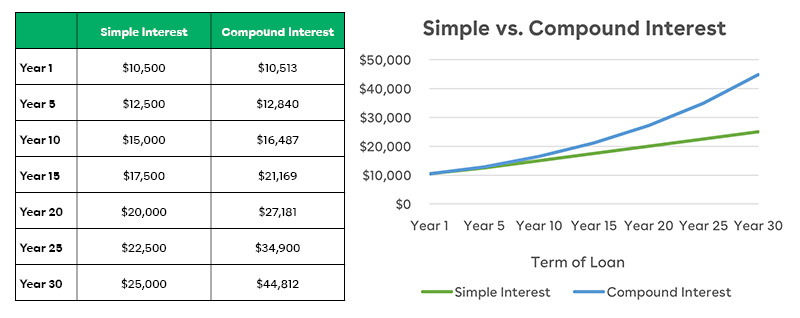

Using the same example of $10,000 invested at a 5% interest rate compounded daily, you collect $512.67 in interest at the end of the first year. This may not sound like a big difference, but over 30 years, your earnings are about 1.7 times that of a simple interest account. See the chart comparing the investment totals for the two interest types:

Insured savings products with guaranteed returns that offer compounding interest accounts provide low-risk savings growth. Variable-rate products may tease higher returns, but because these are not guaranteed, they can also mean more risk. Consider carefully and determine if there are any mandated lower or upper limits on the return to understand the full spectrum of possible outcomes. If you're looking for lower-risk compound interest accounts, savings accounts or CDs will build your wealth with a predictable rate of return.

Key Variables

To calculate compound interest, the variables that determine the total amount (A) of earnings include:

- Principal, or starting balance of the account (P)

- Compound interest rate (r)

- Compound frequency (n)

- Term of the account period in years (t)

The frequency that your investment is compounding can be daily, monthly, quarterly, or yearly. The more frequently the interest is compounded, the more you earn from your investment. The compound interest formula is P (1 + r/n ) ^ (nt) = A, or you can use Texell's online calculator to help determine your savings.

Types of Compound Interest Accounts

There are several types of compounding interest accounts designed to build wealth:

- Savings accounts — These accounts pay interest as long as you aren't withdrawing funds. All Texell members have a savings account as part of their ownership in the credit union, and we only require $5 to open the account. The minimum balance to earn dividends is $100. Learn more and open an account in minutes at Texell.org/Savings.

- Certificates of deposits (CDs) — CDs usually earn more interest than traditional savings accounts, and you can choose from short or longer terms — although longer-term CDs often offer higher interest rates. At Texell the dividends for CDs are paid quarterly, with the option to compound it to the account or transfer the earnings to another Texell account.

- Money market accounts — These accounts offer the same benefits as savings accounts, except you can write checks and make ATM withdrawals. Texell's Money Market Accounts offer a higher prospective annual percentage yield than our savings account, but a minimum deposit of $2,500 is required to open the account and to earn dividends.

- Stocks — As long-term investments, dividend stocks earn a higher return on your investment than other compound interest accounts. When you buy stock, you're investing in a company in the form of a share that you hope increases in value over time. The economy is a major variable in stocks, which makes them a higher-risk investment since they're more volatile.

- Bonds — Bonds are loans to either a company or governing agency that pays interest to the investor. The interest earned is not automatically compounded on these accounts, but the investor can reinvest the interest paid on a bond to compound it. Bonds are considered a less risky investment than stocks.

When you're ready to grow your savings, Texell is here to help. With great rates on CDs, money market, and savings accounts — including Health Savings Accounts (HSAs) and savings accounts for kids and teens — we have many options for earning on your deposits. Our Save First Accounts have ultra-competitive rates that encourage you to save while building an emergency fund. We also keep your accounts safe with deposits insured up to $500,000.¹ Call or text 254.773.1604, visit Texell.org/join, or visit any branch to get started today.

¹ Your deposits are federally insured for $250,000 and backed by the full faith and credit of the National Credit Union Administration, a U.S. Government agency. Your deposits are insured for an additional $250,000 through private insurance provided by Excess Share Insurance Corp.

If you wish to comment on this article or have an idea for a topic we should cover, we want to hear from you! Email us at editor@texell.org.