30-year vs. 15-year Mortgage: Which Is Right for You?

Buying a home is a big decision, and choosing the right mortgage is one you will have to live with for many years. When it’s time to decide which mortgage is right for you, the choice is usually between two options: a 15-year or 30-year mortgage. Both have advantages and disadvantages, and knowing these differences will help you decide which is best for your unique situation. The obvious difference between a 15- and a 30-year mortgage is the repayment term. Let’s take a look at some other important factors to consider.

Buying a home is a big decision, and choosing the right mortgage is one you will have to live with for many years. When it’s time to decide which mortgage is right for you, the choice is usually between two options: a 15-year or 30-year mortgage. Both have advantages and disadvantages, and knowing these differences will help you decide which is best for your unique situation. The obvious difference between a 15- and a 30-year mortgage is the repayment term. Let’s take a look at some other important factors to consider.

Pros of a 15-year Mortgage

A major benefit of a 15-year mortgage is that the interest rates are lower than 30-year loan rates. Since the repayment term is half that of a 30-year mortgage, monthly payments are higher, but home equity builds much faster. If you can budget for the 15-year option, you’ll pay less in the long term. More of your payment goes toward the principal each month, and you’ll save thousands in interest. You will also achieve the goal of owning your home free and clear much faster. Texell recommends a 15-year mortgage simply because you will pay far less for your home with a 15-year mortgage.

Pros of a 30-year Mortgage

A 30-year mortgage often carries a higher interest rate but lower monthly payments since the loan is spread out over a longer period. For those on a tight budget, the 30-year option is often the only feasible one. With a fixed interest rate, you can count on the monthly payments staying the same, although taxes and insurance costs may change. Since the payments are lower, you may qualify for a more expensive house than with a 15-year-mortgage. If your income increases, you have the flexibility of paying more toward the principal each month, reducing the term of the loan.

Tax Considerations

The interest paid on your mortgage can be deducted for homeowners who itemize tax deductions. Take into consideration whether the tax deduction outweighs the costs of the extra interest paid on the longer-term mortgage. Consult with your tax advisor to determine how the deduction applies to you.

How Much Will You Pay?

While it’s tempting to opt for a 30-year mortgage since the monthly payments are lower, a 30-year mortgage costs more in interest, making it more expensive. With a 15-year mortgage, you’ll pay more toward the principal and less in interest over the life of the loan. The amount of time that you will be in debt is also cut in half, freeing up your funds for investments and other financial plans.

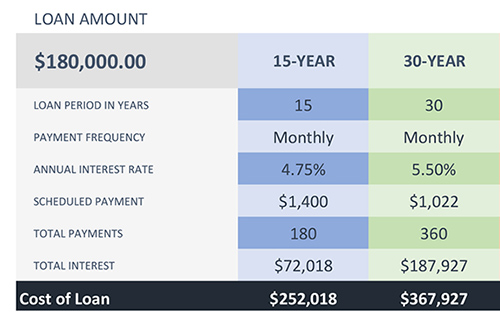

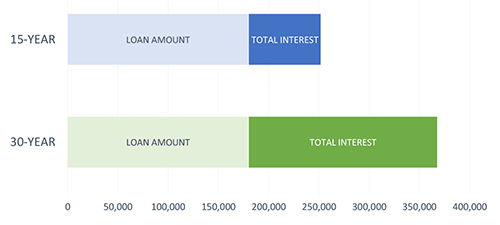

Let’s say you are purchasing a $225,000 home and will be putting 20% down. This means you have a $45,000 down payment and a $180,000 mortgage loan. Here’s how it breaks down:

A 4.75% interest rate on a 15-year loan and a 5.50% interest rate on a 30-year loan is a difference of $115,909 in interest over the life of that mortgage. That’s a large sum that can be freed up for something other than your mortgage.

What Will You Do With the Savings?

If you were to pay off your home and redirect the $1,400 monthly payment to investments, you would gain 15 additional years of building toward other financial goals, such as saving for college or increasing retirement contributions.

With the 30-year mortgage option, you might be able to put away a smaller amount each month. Let’s say you invest the additional $378 difference in payments with the 30-year option. If you are disciplined enough to consistently make this investment, you will come out ahead in 30 years if the average return is high enough.

In our example, the 15-year option saves interest and gives you a larger amount to build wealth. If you invested the same amount you were paying for your mortgage in the stock market, with an average 7% rate of return, you would have $447,736 after 15 years. Investing $378 per month at the same rate over 30 years will bring $464,217, but you’re still at a loss since you paid $115,909 more in interest during that same time frame. Choosing a 30-year mortgage with the intent to also invest is not always feasible, since most people who choose a 30-year mortgage rely on the lower monthly payment and don’t have the extra to spare for investments.

Which Type Are You Qualified to Receive?

Before seeking preapproval for a loan, make sure you’re financially ready. Pay off credit cards and other debts, set a budget, and save for a larger down payment to give yourself the best chance of getting qualified for either loan type. It may be easier to qualify for a 30-year mortgage; however, it’s worth looking to see if you qualify for a 15-year as well. Use Texell’s online calculator to determine your estimated monthly payments to make an educated decision.

Need Help Deciding?

If you are unsure which option is right for you, our Texell Home Loan Heroes can look at your unique situation and help answer your questions. Call us today at 254.774.5104 or visit TexellHomeLoans.com, and we can start the process of getting you pre-approved for your new home.

If you wish to comment on this article or have an idea for a topic we should cover, we want to hear from you! Email us at editor@texell.org.